SrochnoDengi web and mobile apps for micro and online loans

Client: Srochnodengi

micro and online loans

Microfinance — speed and flexibility

Microfinance organizations constitute a large stratum of Russian and global fintech. They have gained popularity due to their ability to provide people with urgent financial support.

Microfinance — speed and flexibility

In this project, Spider Group's main objectives were to make regular improvements and changes to the project in order to increase customer satisfaction and achieve the customer's business goals.

The new standard of effective customer service is a minimum of communication with employees of the company and the ability to manage financial products services independently.

It is impossible to make a product for the microfinance market once and for all. Regular improvements are needed to increase customer satisfaction, comply with legislation and achieve new business goals.

Architecture

The project includes an intermediate server. It is responsible for communication with the mobile and web apps, provides integration with the internal loop and external systems, enables synchronous interaction of parts of the project and keeps the data up to date for the user and company employees.

No personal data of customers and their cards are stored here. This way we minimize the risk of leaks and make the solution more flexible for new integrations.

Single loop and security

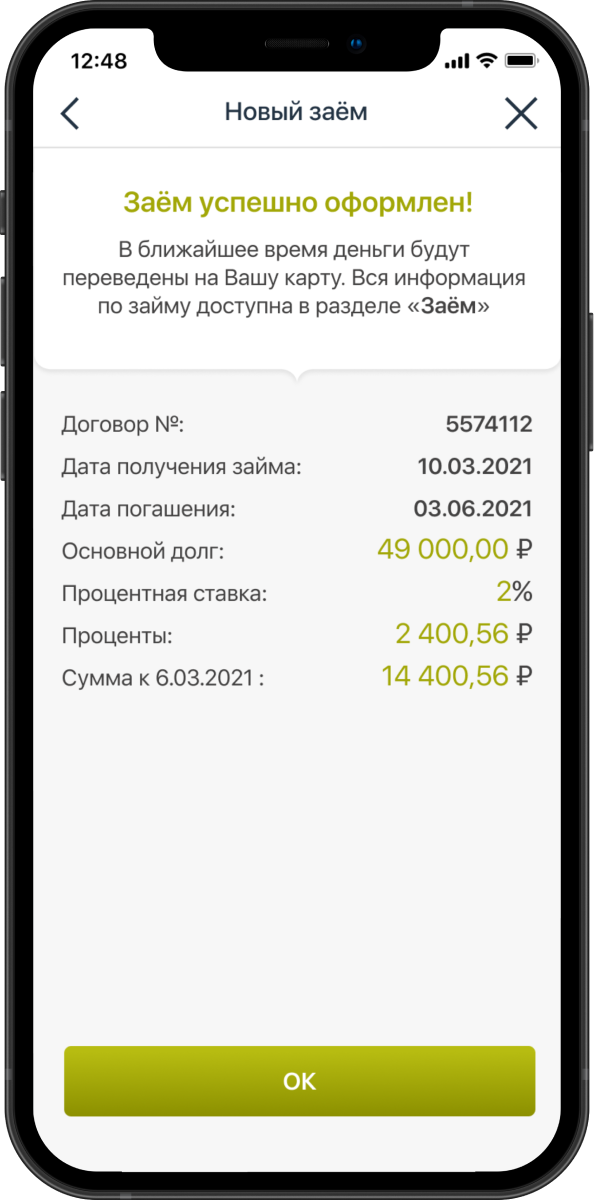

The customer can interact with the company in different ways: offline, via a mobile app or web interface. In any scenario, data is synchronized without delay. For example, if you repay a loan at a company office, the information about it will appear in the app immediately.

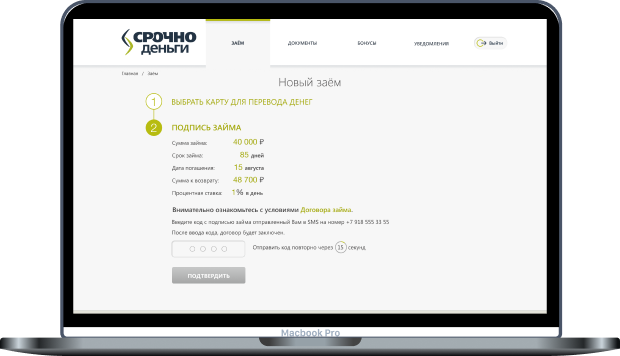

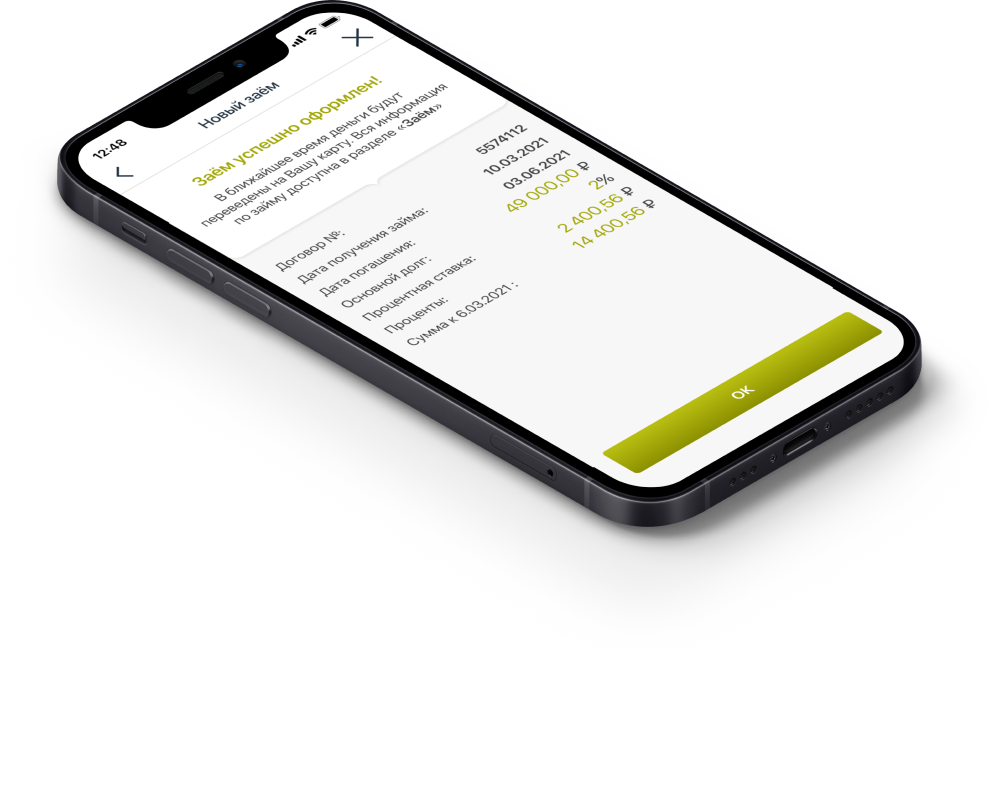

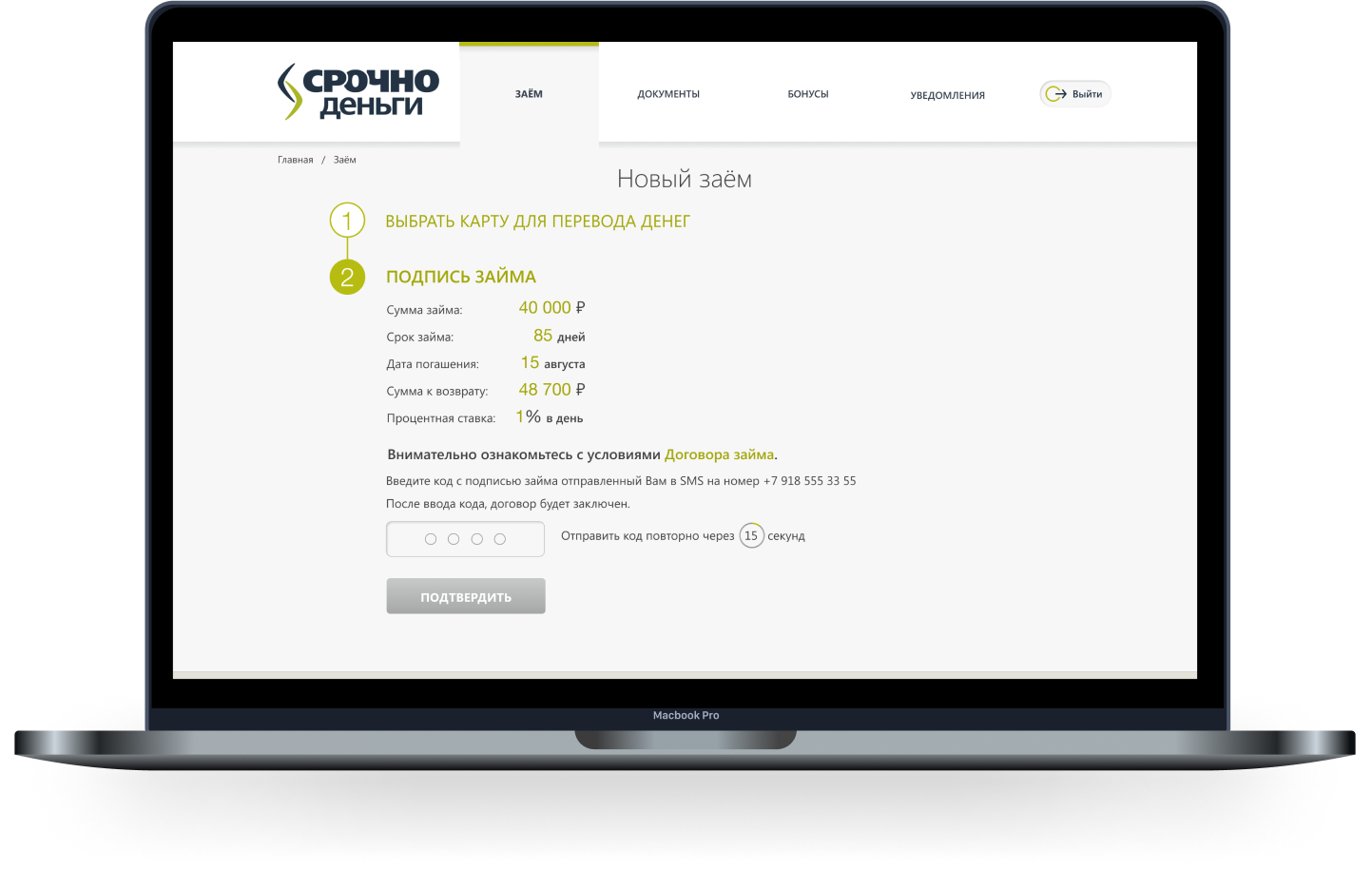

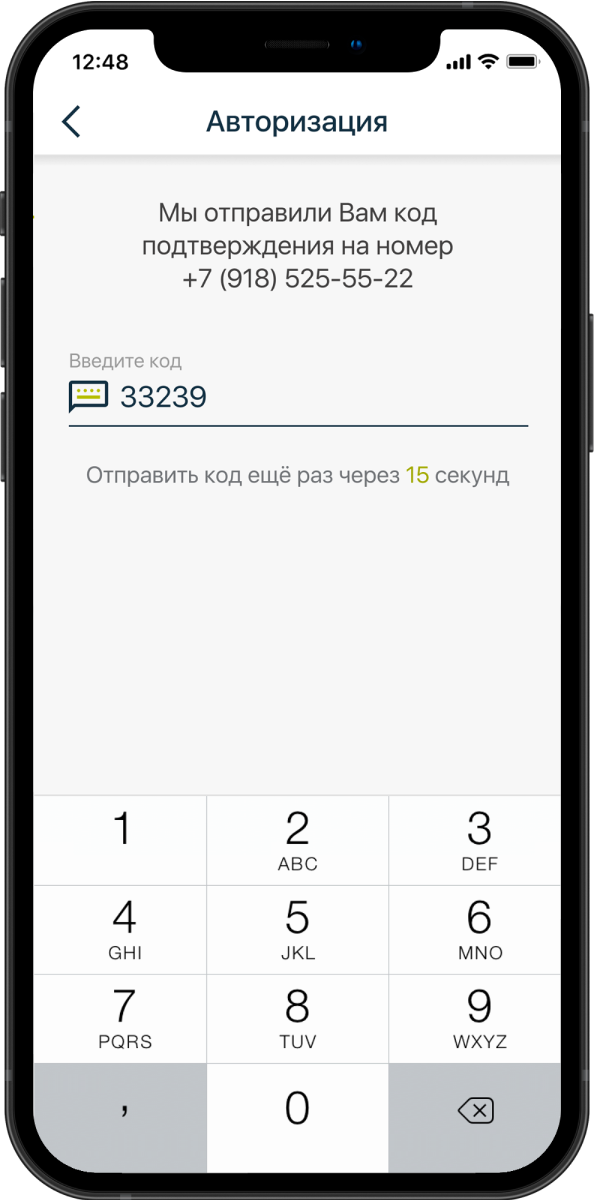

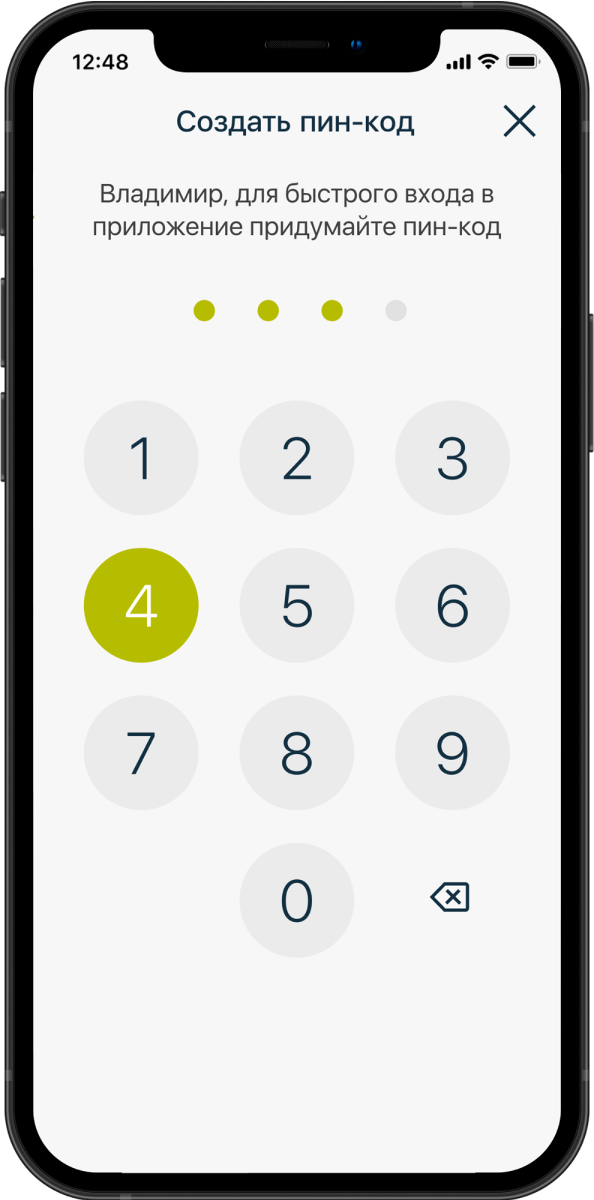

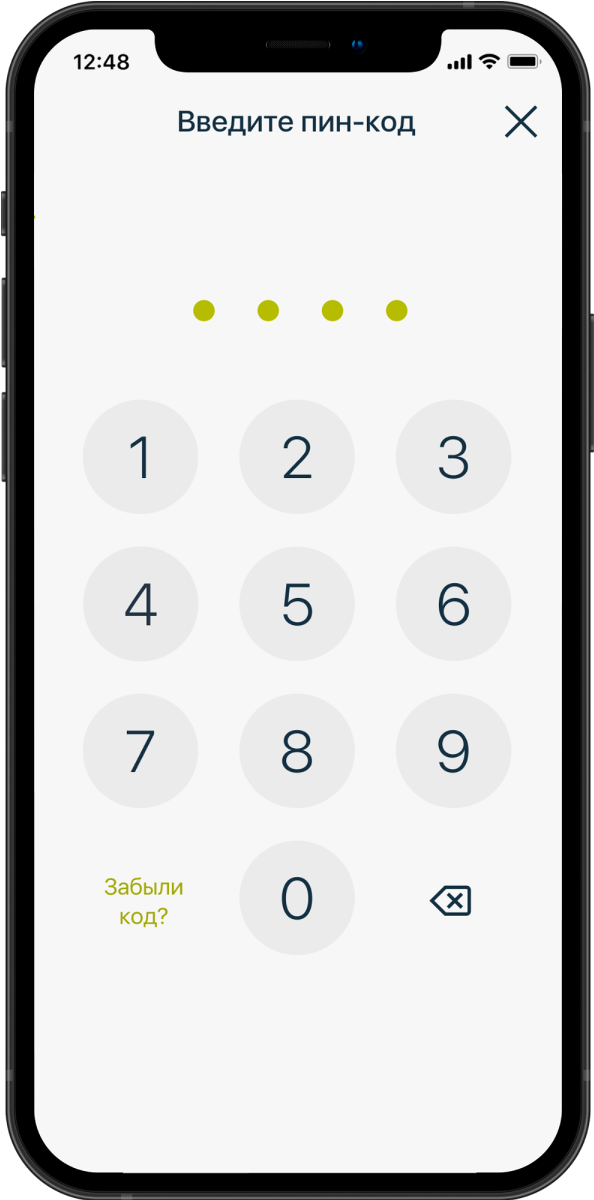

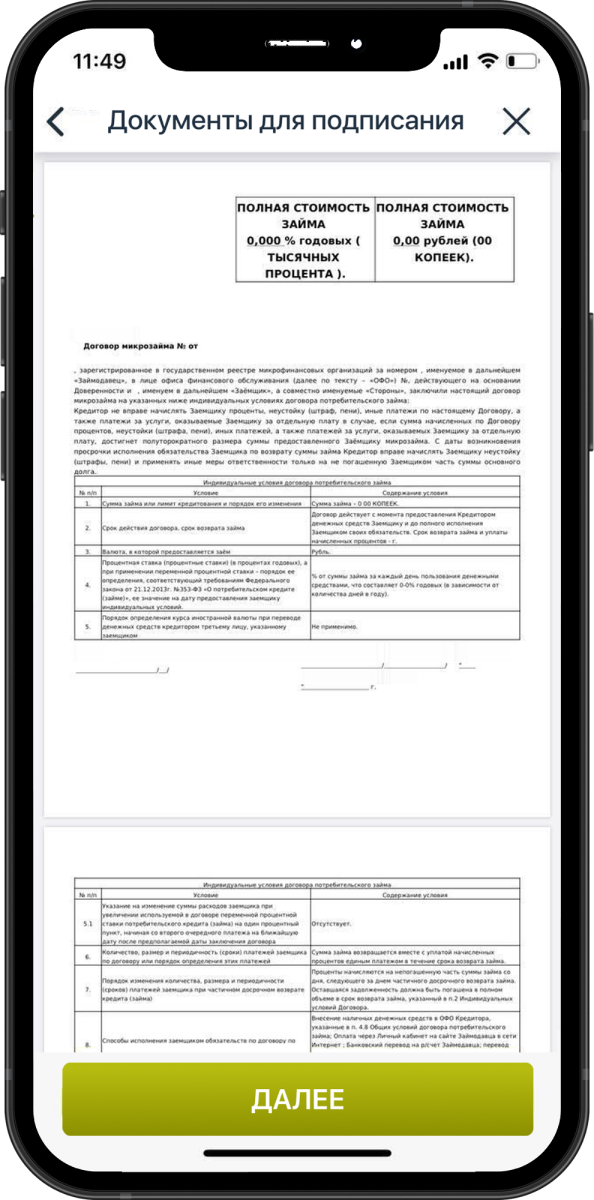

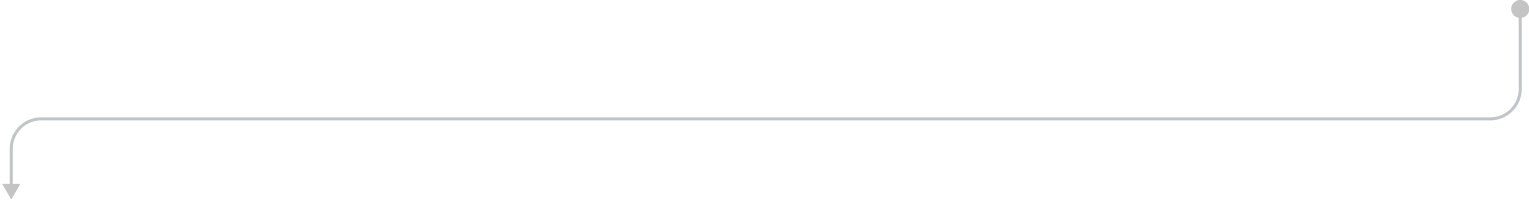

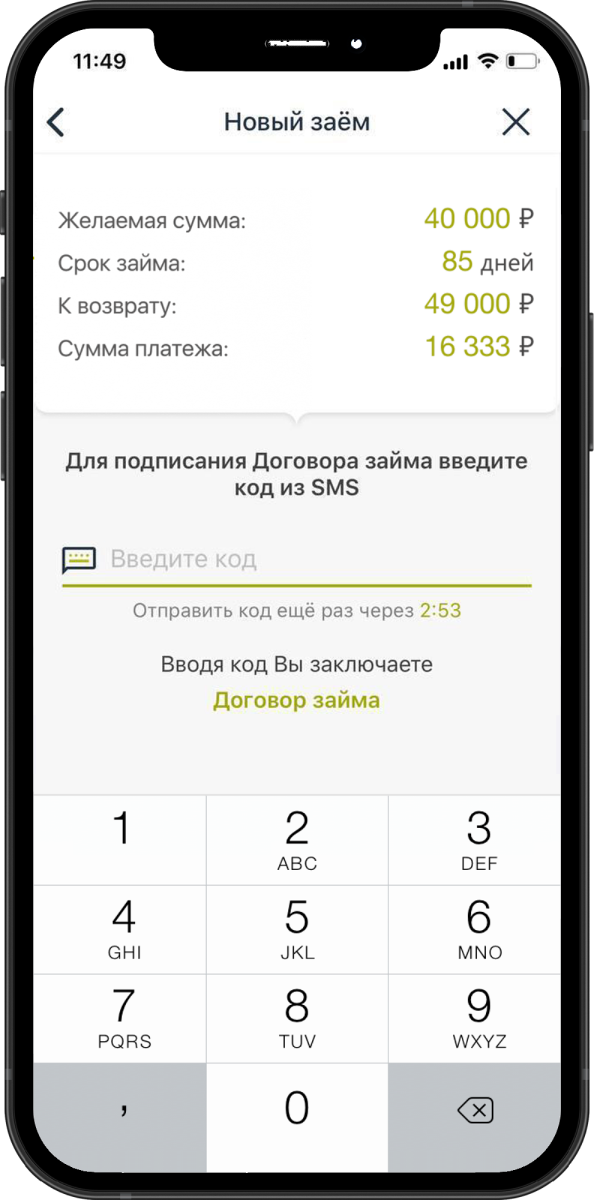

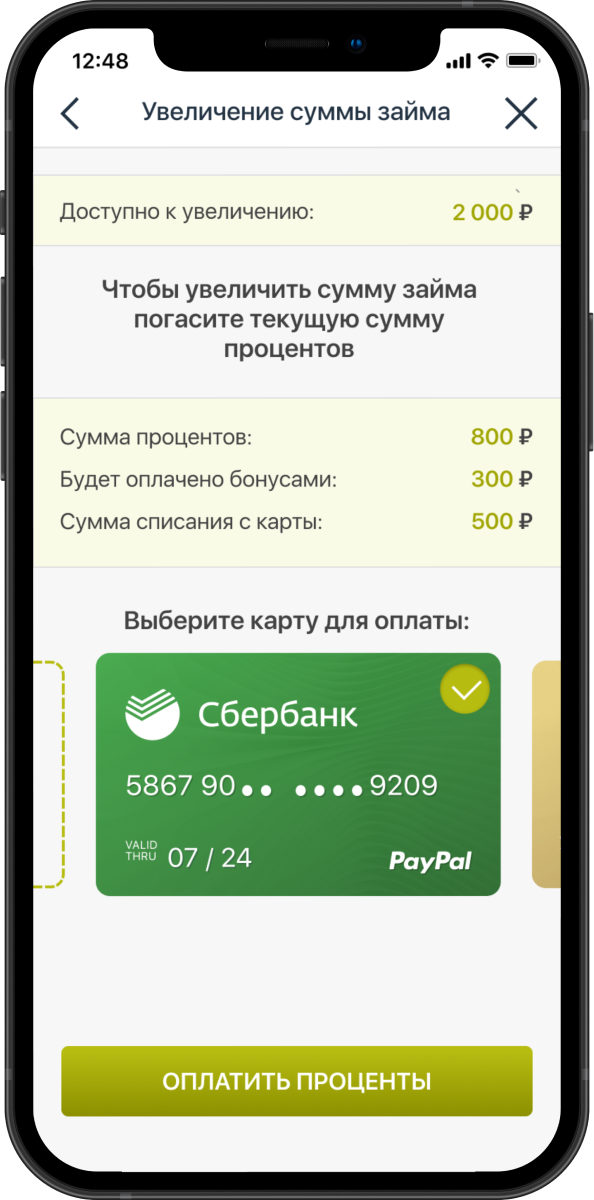

All actions with the loan, including execution of a new loan, increasing the term or amount, are accompanied by explicit confirmation from the client by entering the SMS code and providing comprehensive information on the transactions carried out. This mechanism gives confidence in the client's understanding of his or her actions. It also minimizes possible conflict situations, protecting the user from accidents and mistakes.

Relevance

Having a digital platform for communicating with customers has long been a first necessity, not a competitive advantage. The proximity of a financial company to people, speed and the ability to receive services from anywhere in the world have become conditions for existence in the market.

Convenience and simplicity of service are the criteria by which the client decides to stay with the company or choose a competitor, even if your conditions are more favorable.

Product improvements according to current needs and technologies lay the foundation for business. They should be regular and mandatory. Innovation allows to remain unique in a saturated market.

Site

screens

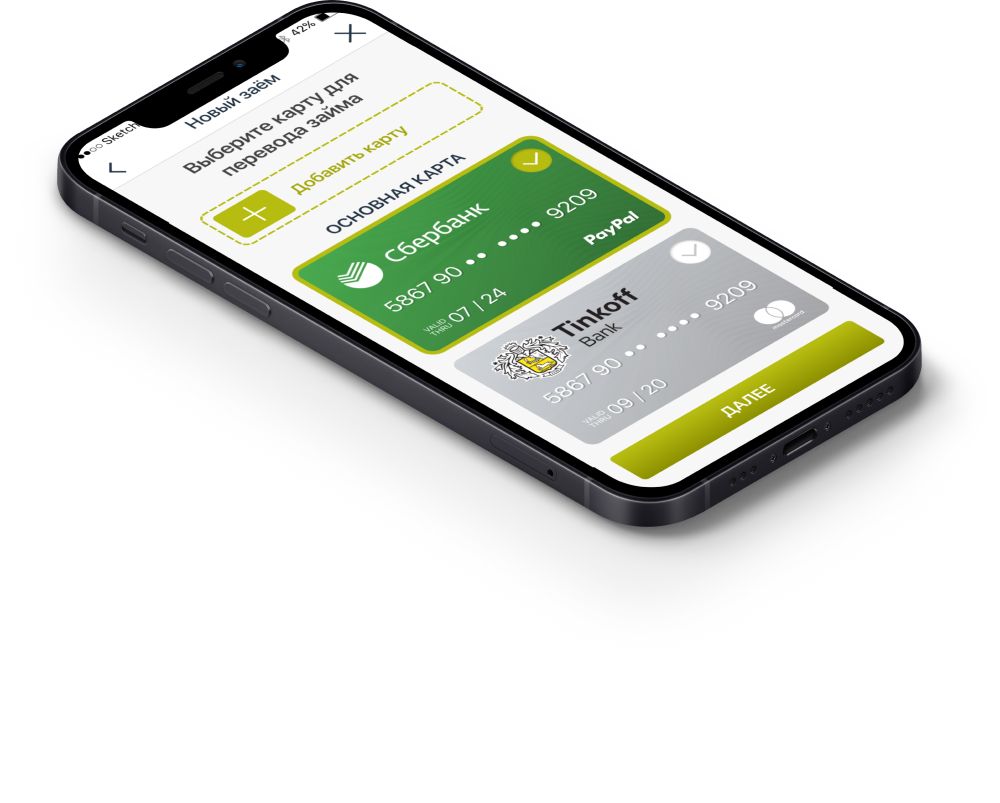

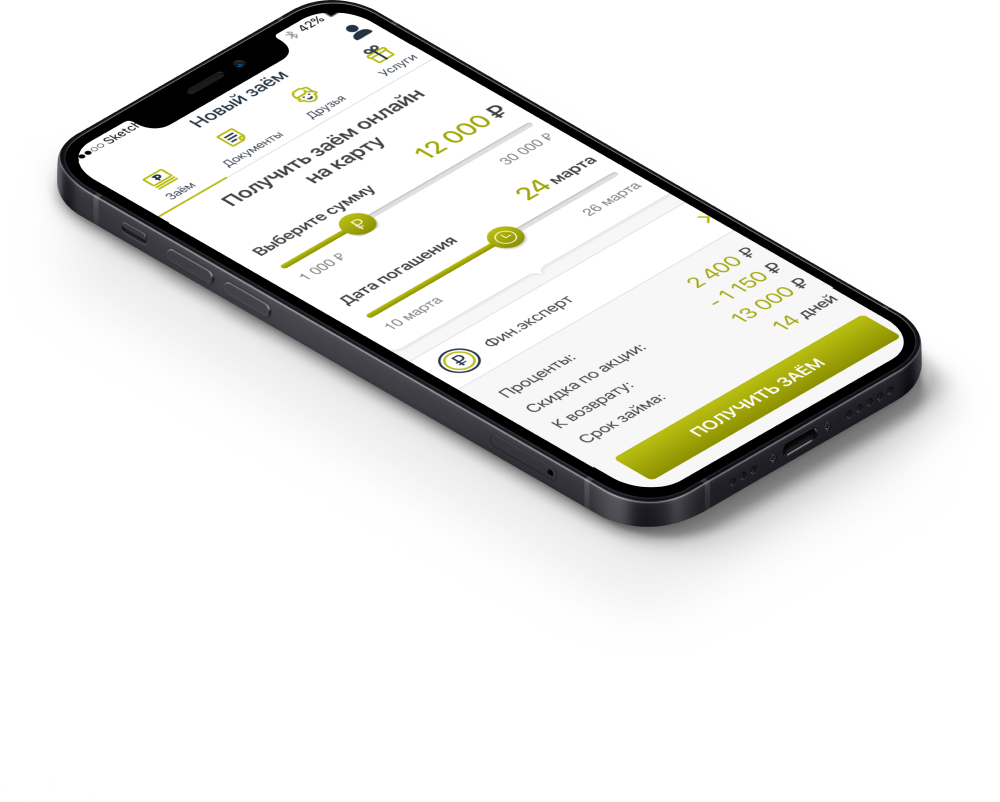

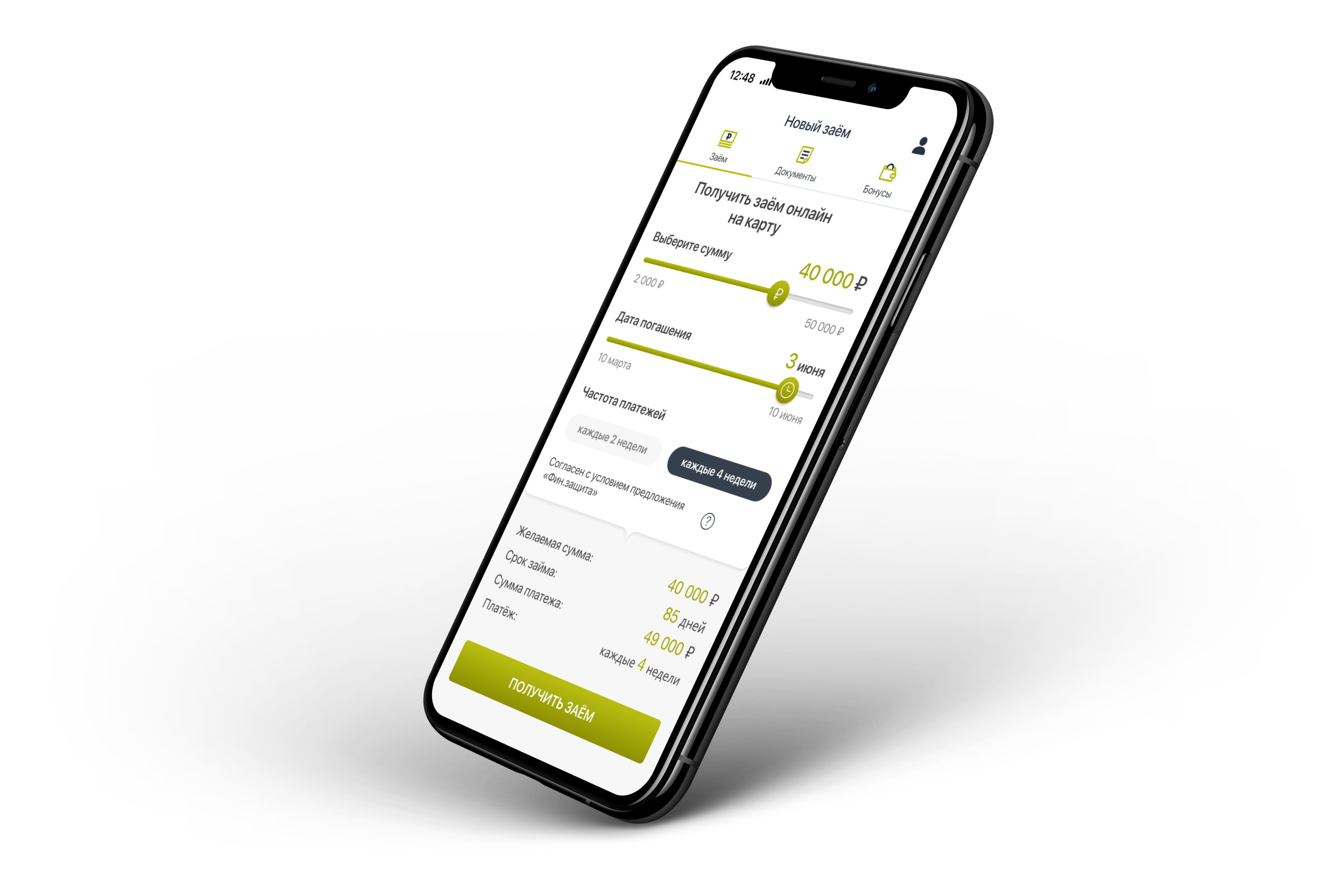

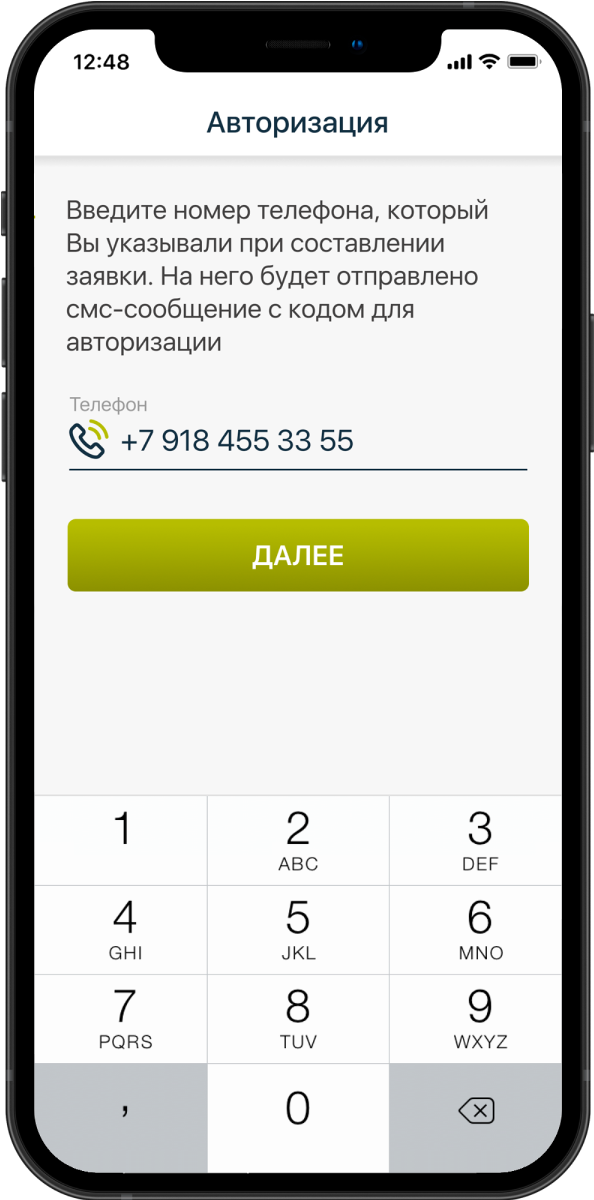

App

screens

Analytics

Any innovation or existing functions change is impossible without a thorough analysis. As part of the implementations we worked out functional changes and interfaces of the affected systems together with the customer's team.

Regular project requirements updates and maintaining documentation allows all participants to keep the project stable and reduce the time for changes.

UI/UX

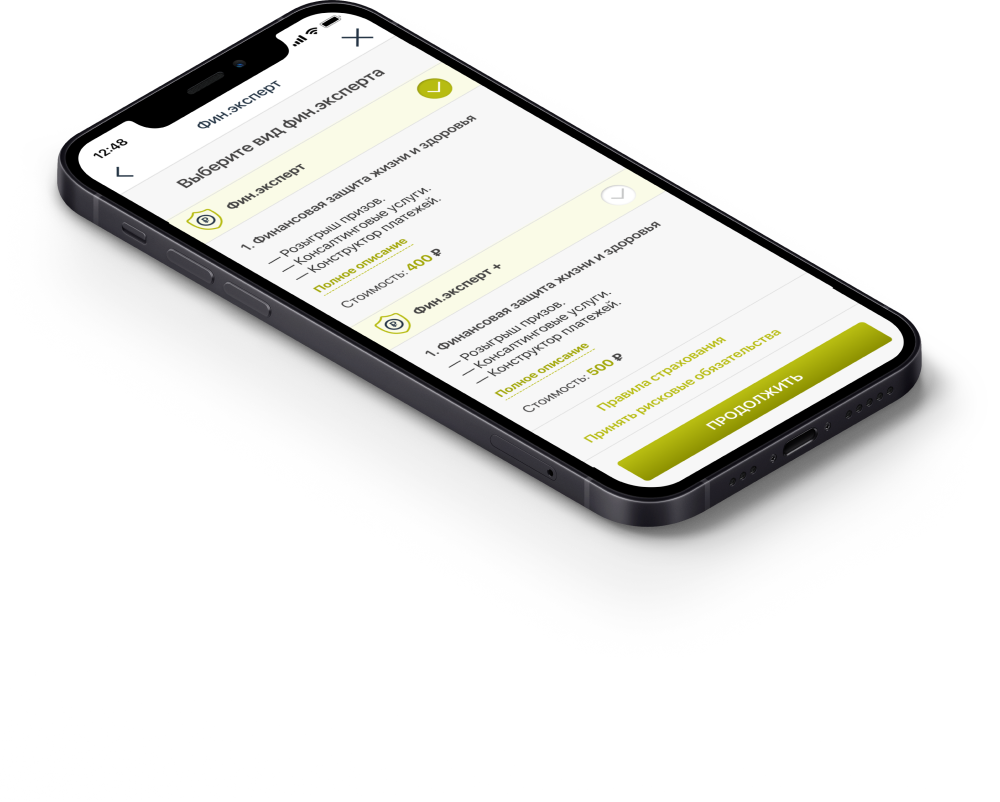

Any feature change or innovation introduction isn’t only analytics and integration, but also the UI redesign. With these changes, we must keep financial services accessible to a wide range of consumers.

The evaluation of the quality of the chosen solution is built from various metrics, including user interaction and financial performance. We regularly discuss them with the customer to understand the effectiveness of the work and look for potential improvements.

Authorization

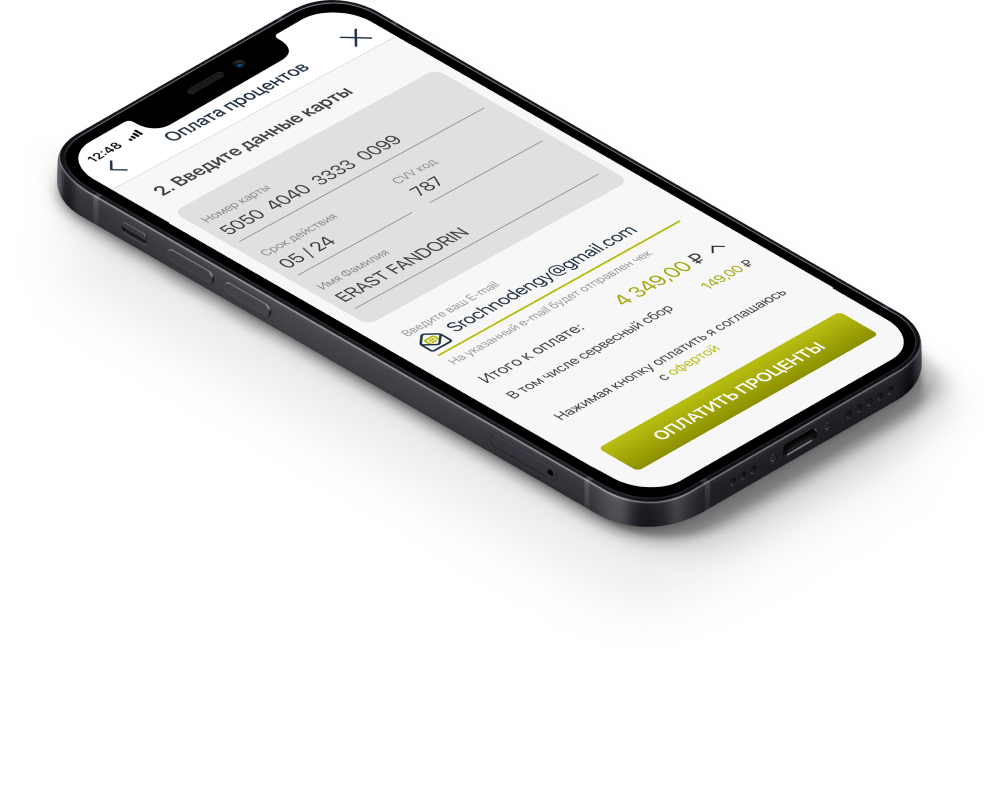

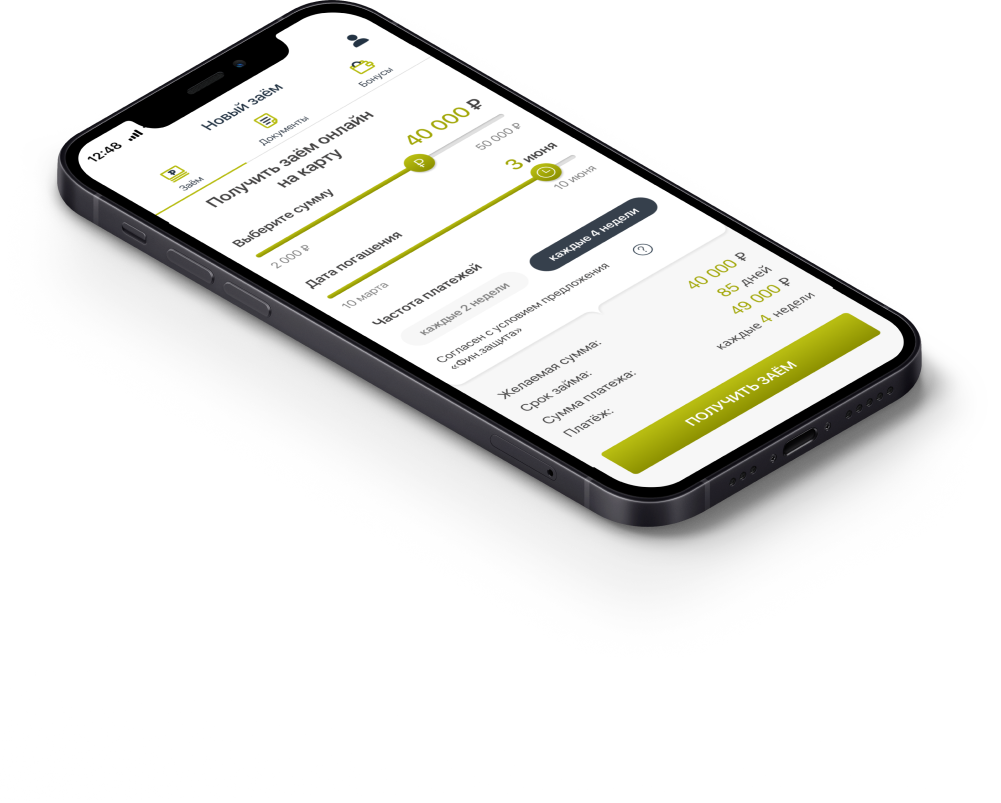

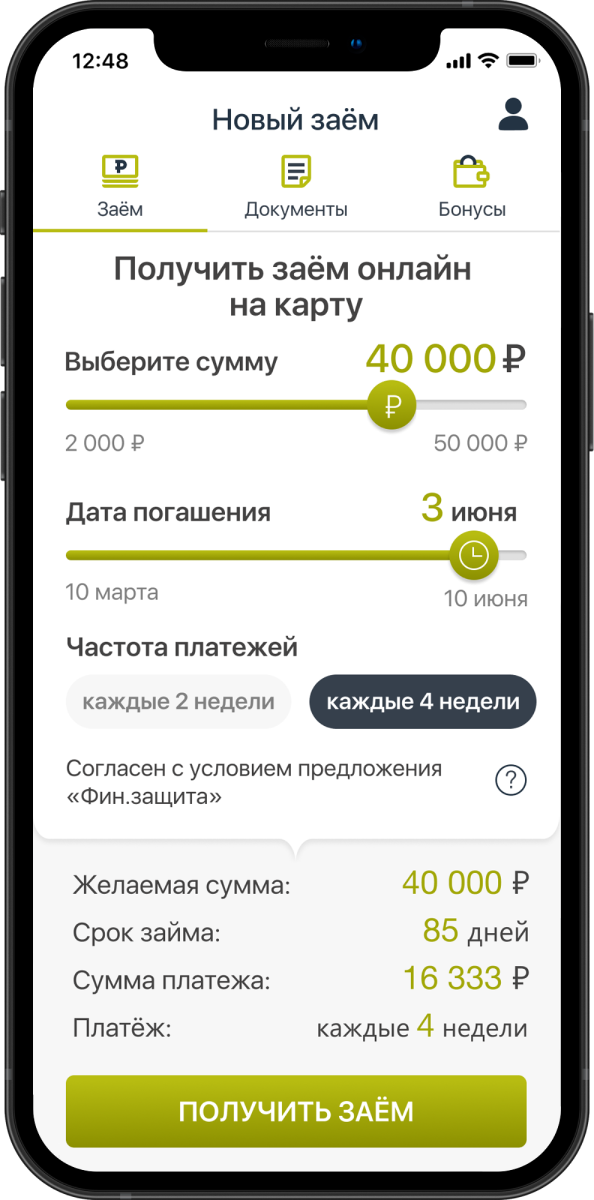

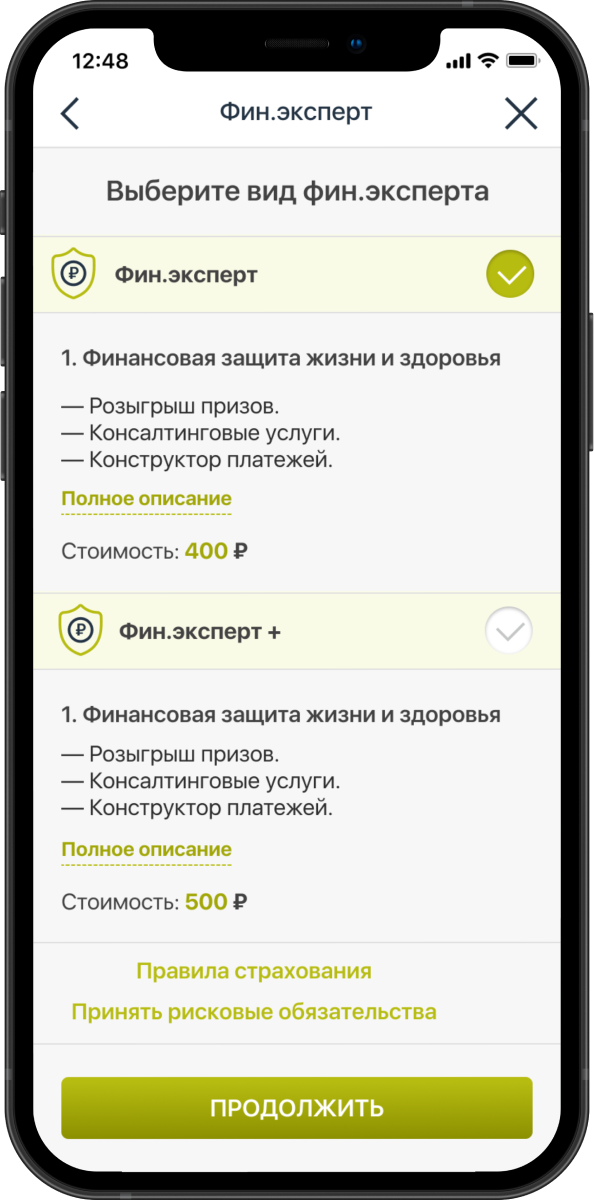

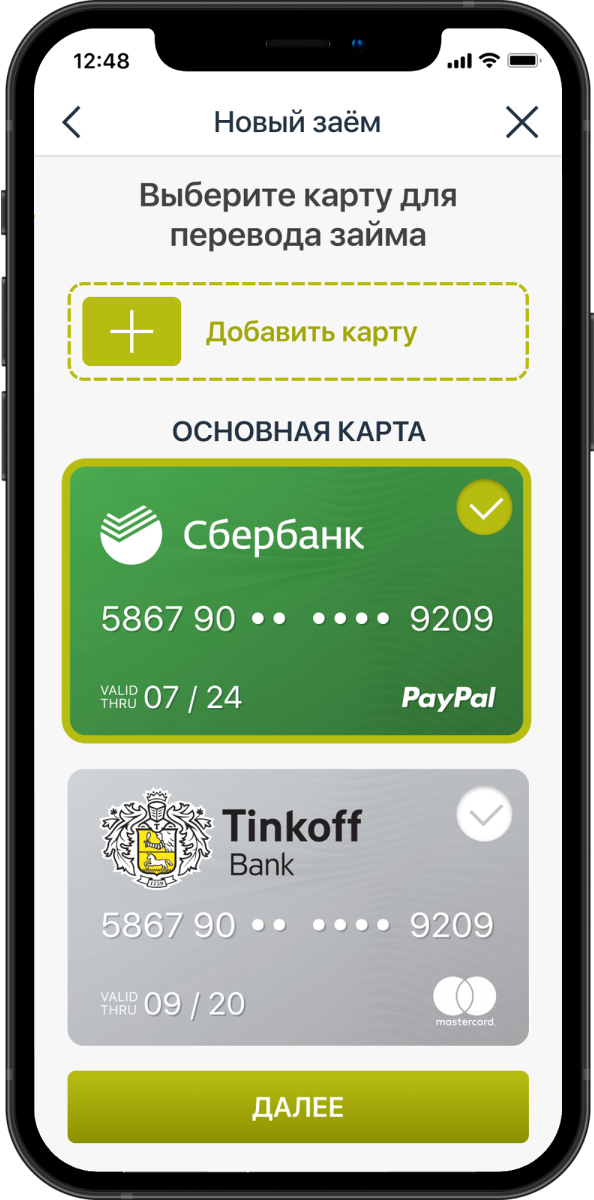

New loan

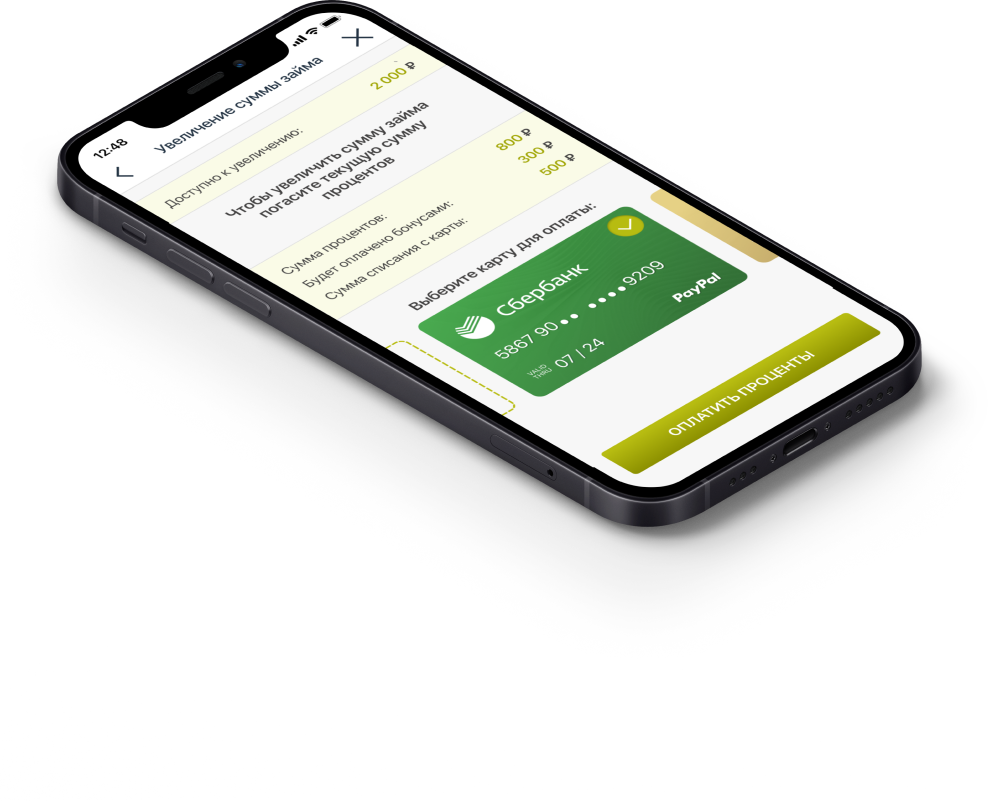

Increase in

the loan amount

User benefits

- No need to visit the office

- No waiting in line

- No need to talk to a manager

- Payment, extension, repetition of the loan online

SrochnoDengi benefits

- Increase of customer loyalty

- Business process automation

- Reducing the office workload

- Simplification of re-loan disbursement procedure

Fonts and colors

For iOS / Android app

For web interface

Primary colors

Additional colors

Development statistics

- Analytics — 150 hours

- Design — 130 hours

- Web development — 225 hours

- iOS development — 120 hours

- Android development — 120 hours

- Backend development — 350 hours

- Management — 230 hours

- Testing — 160 hours

Development team

- Business Analyst — 1

- Project manager — 1

- UX-designer — 1

- Web-developer — 1

- iOS developer — 1

- Android developer — 1

- Backend developer — 1

- Tester — 1